- JohnWallStreet

- Posts

- NASCAR’s Returns to Roots Strategy About Restoring Credibility, Foundation for Growth

NASCAR’s Returns to Roots Strategy About Restoring Credibility, Foundation for Growth

sports. media. finance.

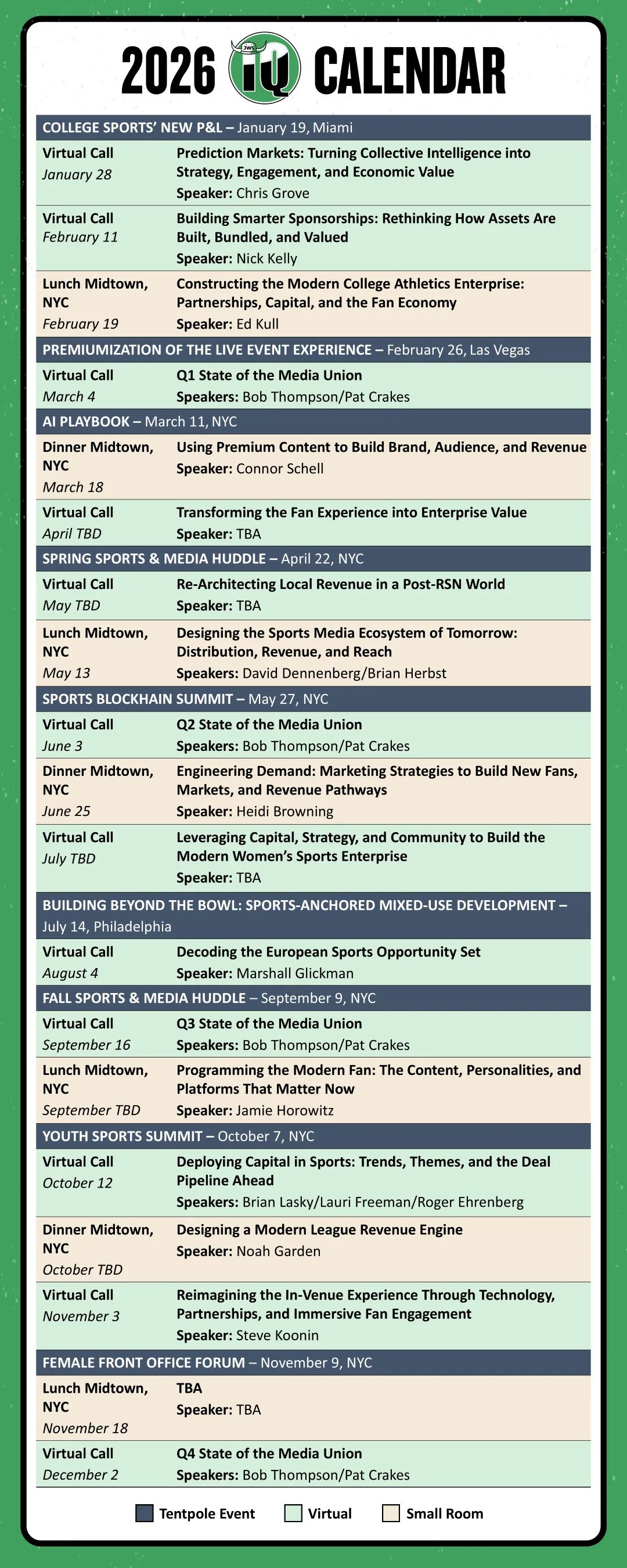

The first JohnWallStreet IQ members-only virtual call of the year is next Wednesday January 28 (at 3:30p EST). The subject is prediction markets and turning collective intelligence into strategy, engagement, and economic value. Acies Investments co-founding partner Chris Grove will lead the conversation.

Interested in joining JohnWallStreet’s Intelligence Quorum? Reach out to Corey Leff at [email protected] for more information including annual membership pricing and availability.

NASCAR’s Returns to Roots Strategy About Restoring Credibility, Foundation for Growth

NASCAR recently announced plans to bring back a modified version of its early-2000s “Chase” playoff format for the upcoming season (starts Sunday with the Cook Out Clash at Bowman Gray Stadium).

The move was less about business KPIs and more about reestablishing credibility. Prominent drivers and the sport’s fan council felt the previous structure, where one race decided the champion, was ‘a bit gimmicky’.

“There were some loud voices saying that the format needed to be revisited. So, we did,” Tim Clark (EVP, Chief Brand Officer, NASCAR) said.

NASCAR’s new playoff structure rewards performance throughout the season and will help to ensure ‘the right’ champion is crowned. It was also designed to restore faith amongst long-time fans at a moment when many sports properties are chasing younger audiences.

“It’s a little bit of a back to our roots strategy,” Brian Herbst (EVP, Chief Media & Revenue Officer, NASCAR) said. “What we saw in the last TV deal was while younger viewers were up ~15% YoY, our core fans 50+ declined.”

While every rights owner seeks to cultivate the next generation of fans, NASCAR has come to realize keeping its established audience engaged is a prerequisite for future growth.

“I don't think there's any sport where you can appeal to a new fan base if you're not able to retain your core and bring them along because they're your biggest advocates,” Clark said. “We have all the data in the world to suggest that the biggest way to influence new fans is generational, which means existing fans are [shaping] the next generation of fans.”

We’re hiring at JohnWallStreet!

We’re looking for a hungry, thoughtful B2B Advertising Sales professional who wants to sell access to one of the most influential, senior audiences in the sports business.

This is a great opportunity for someone who understands how to sell a premium digital product in a world shaped by AI, automation, and crowded inboxes—where preparation, credibility, and persistence still win. You’ll be selling a trusted product to C-suite decision-makers across teams, leagues, media, finance, and the broader sports ecosystem, with a primary focus on our digital suite~ including the JohnWallStreet newsletter, website and podcasts.

The role is fully remote (with minimal travel), offers meaningful upside for strong performers, and the chance to work alongside a small, high-caliber team shaping the future of sports business media.

If this sounds like you—or someone you know—reach out to [email protected].

The NASCAR Cup Series season simply consisted of 36 equal points races between 1975 and 2003 (aka the modern points era). The driver who tallied the most points throughout the campaign was crowned champion.

While that format made sense from a competitive integrity standpoint, it created the possibility of a champion being crowned prior to the last race. So, once the television money started to get big, the networks didn’t want to be paying for lame duck races at the end of the season.

NASCAR instituted ‘The Chase’ to add storylines and better compete with the NFL during the back half of its slate in 2004. Remember, the racing circuit performs best, from a viewership perspective, at the outset of its season (think: Daytona 500 in February).

Instead of having 36 points races, 26 regular season events would determine the sport’s postseason field. Then, the last 10 settled its champion.

The original Chase format lasted through the 2013 season.

“We saw, even with that, scenarios where a driver would just have to finish in 15th place or something to win at our championship race,” Herbst said. Consequently, NASCAR moved “to the next level in 2014, which was adding elimination races that cut the field from sixteen to twelve to eight, and then the final four drivers competed in the last race of the season. Whoever finished the best out of those four would win the championship.”

That structure made for good television. But having a loose tire or restart in the final race influence the season-long champion upset drivers and purists alike.

NASCAR began to look at alternative models again following the ’24 season. The feedback received this time around from a diverse committee consisting of 34 NASCAR executives, current and former drivers, team executives, OEMs and TV partner representatives was to return to a version of the format it used during the sport’s mainstream TV heyday.

For context, the 2006 Daytona 500 drew 19.355 million viewers.

NASCAR’s decision to bring back ‘The Chase’ is a seemingly rare example of a sports property prioritizing its core fans over its television partners—even if the sanctioning body doesn’t frame the move that way. It sees the popular change as part of a broader compromise with loyalists.

Keep an eye out for marketing/content campaigns that lean into the sport’s history and distinctly American tradition this season.

There has “been a lot of change in a short period of time when you think about shifting from linear TV to digital streaming, on top of adding three media partners,” Herbst said. “There might be something to going back to a format long-standing fans might be more familiar with or gravitate towards.”

Other properties might want to consider following NASCAR’s lead and offer up concessions to foundational fans.

Nearly every rights owner has made dramatic changes to its product in recent years in an attempt to appeal to next-gen fans (think: MLB and pitch clock, NBA and in-season/play-in tournaments, CFP expansion from 4 to 12 teams). Some, including NASCAR, have overemphasized those efforts at the expense of their core audience.

Sports executives “talk a lot about that 18 to 34 demo. For us, that equates to ~250,000 viewers per event; about 5%, 6%, 7% of our total viewer base,” Herbst said. “There's a need to keep the relative scale of that audience in perspective.”

Especially, for a rights owner, like NASCAR, that remains heavy on linear TV distribution.

Properties that stray too far from what their existing fans expect do so at their own peril.

“That’s the foundation,” Herbst said. “Everything else is built off their engagement.”

NASCAR is returning to a format that peaked 20 years ago. Consumption patterns and fan behaviors have shifted dramatically since. Naturally, it’s logical to wonder if ‘The Chase’ will still resonate.

The internal belief is it will. NASCAR will be able to determine if the format is spurring an increase in fan interest and/or consumption based on some hard KPIs (think: ticket sales, visits to O&O media properties).

However, “we had to start with credibility amongst our drivers and our teams,” Herbst said. “If you don't have credibility among the stars of your sport, it's pretty tough to get buy-in from the fans.”

In an era where most leagues continue to optimize for hypothetical future audiences, NASCAR is starting with the people they know already care and will be vocal champions for it.